Expertise

Wheat, maize & Co: It's getting more expensive

Martin Banse and Verena Laquai | 08.04.2022

Russia and Ukraine are global players in agricultural products such as wheat, maize and oilseeds. Export stops and price increases can lead to disruptions, especially in the countries of the global south.

Russia and Ukraine have become one of the most important exporters of wheat and maize as well as oilseeds (including sunflower seed, soybean) in the last 10 years. For example, in 2020, about 19% of global wheat exports came from Russia and 9% from Ukraine (source: UN Comtrade). According to FAO/OECD projections - before the current war - the importance of these two countries should grow. In the event of a war- and sanctions-related shortfall in exports of these goods, world market prices can be expected to rise significantly.

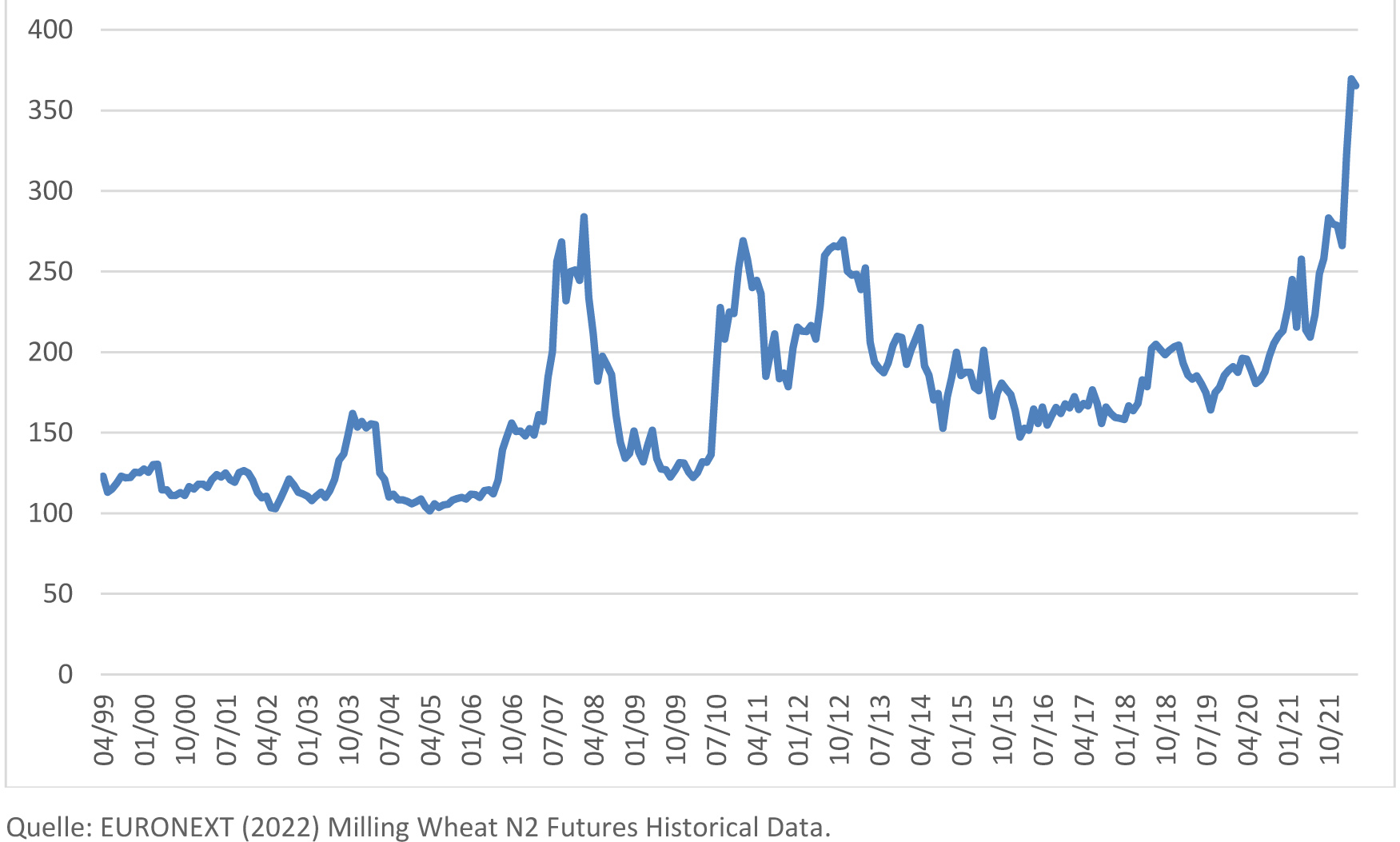

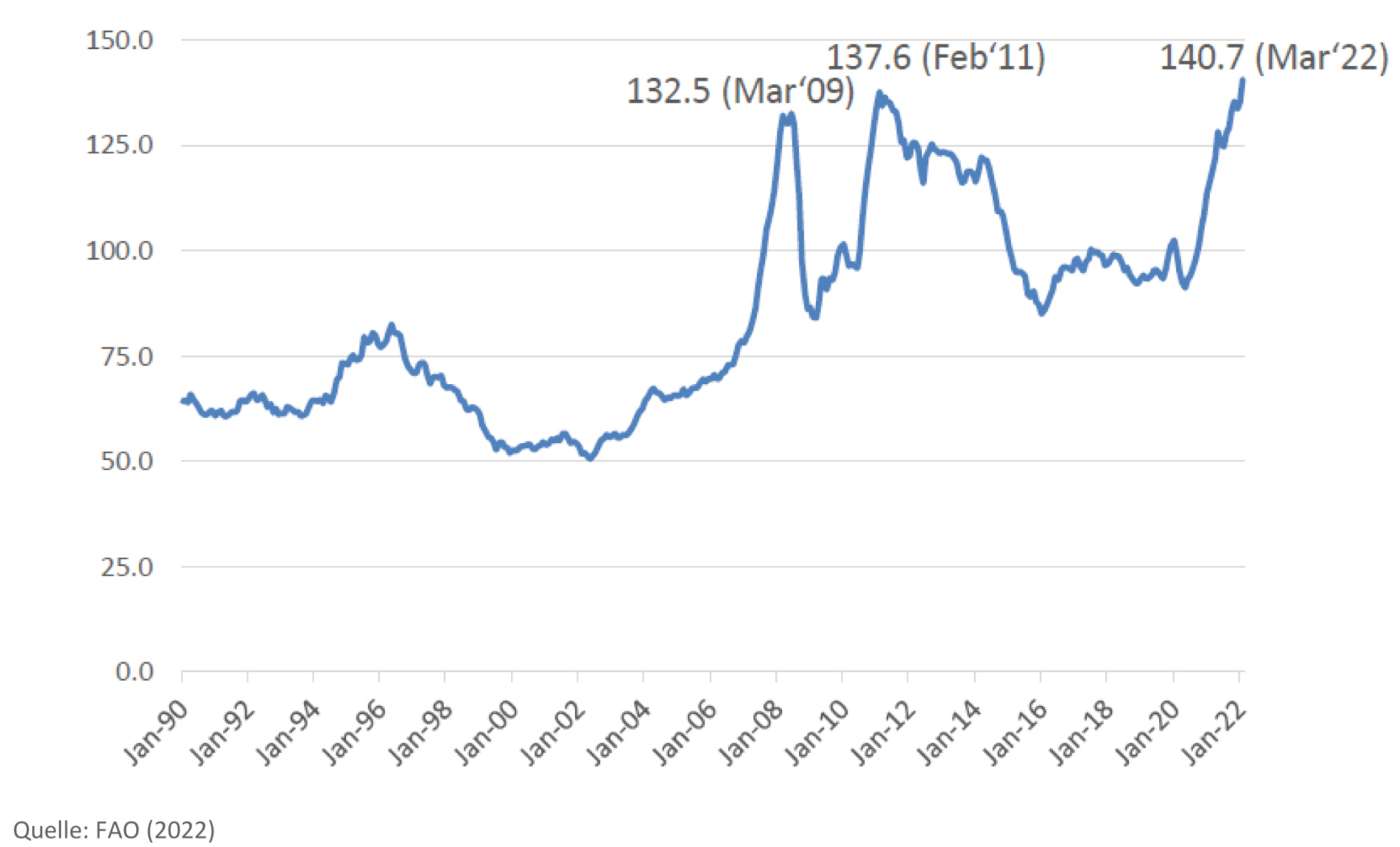

Current market reactions, with wheat prices currently even above 350 USD/t, indicate an upward trend higher than in the "food price crisis" of 2007/08 (Fig. 1). It should be noted that the market situation in the current marketing year was already tight, especially for wheat, due to low stocks and high prices even before the outbreak of the war. As a result, the market is also reacting with these extreme price swings. In addition, Russia is a major exporter of fertilizers. If there is a shortage of Russian quantities on the world market, this will probably further aggravate the already tense situation.

EU supply situation stable, other countries more affected

The supply situation in the EU for cereals and oilseeds is stable. For wheat, for example, the EU and Germany have a self-sufficiency rate of over 100% (AMI Market Balance Cereals). However, many food importing countries are particularly affected by the current uncertainty and volatility. Russia and Ukraine together accounted for 16% of all global grain exports by value in 2020. Both countries export to similar regions, particularly Africa and Asia.

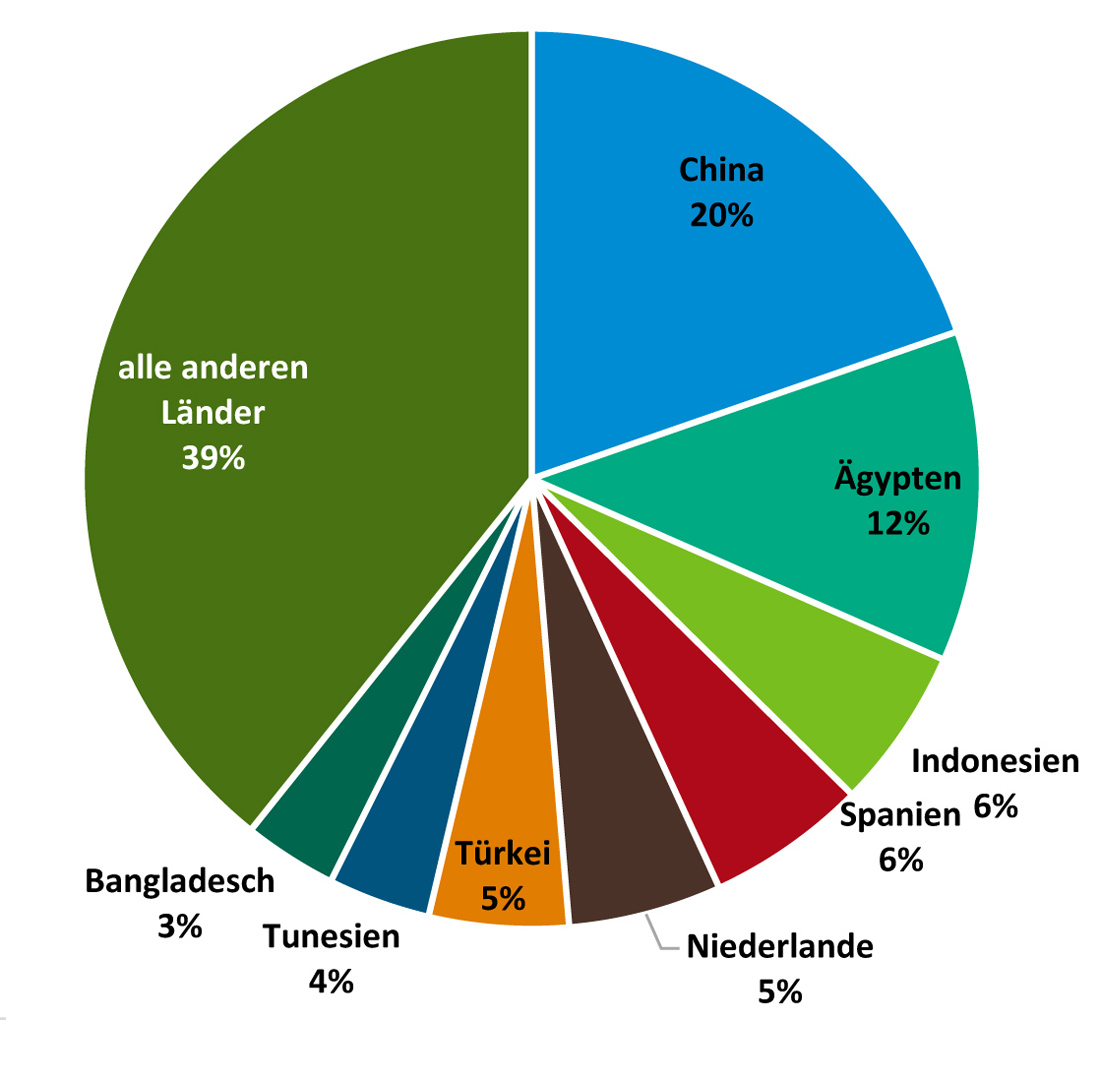

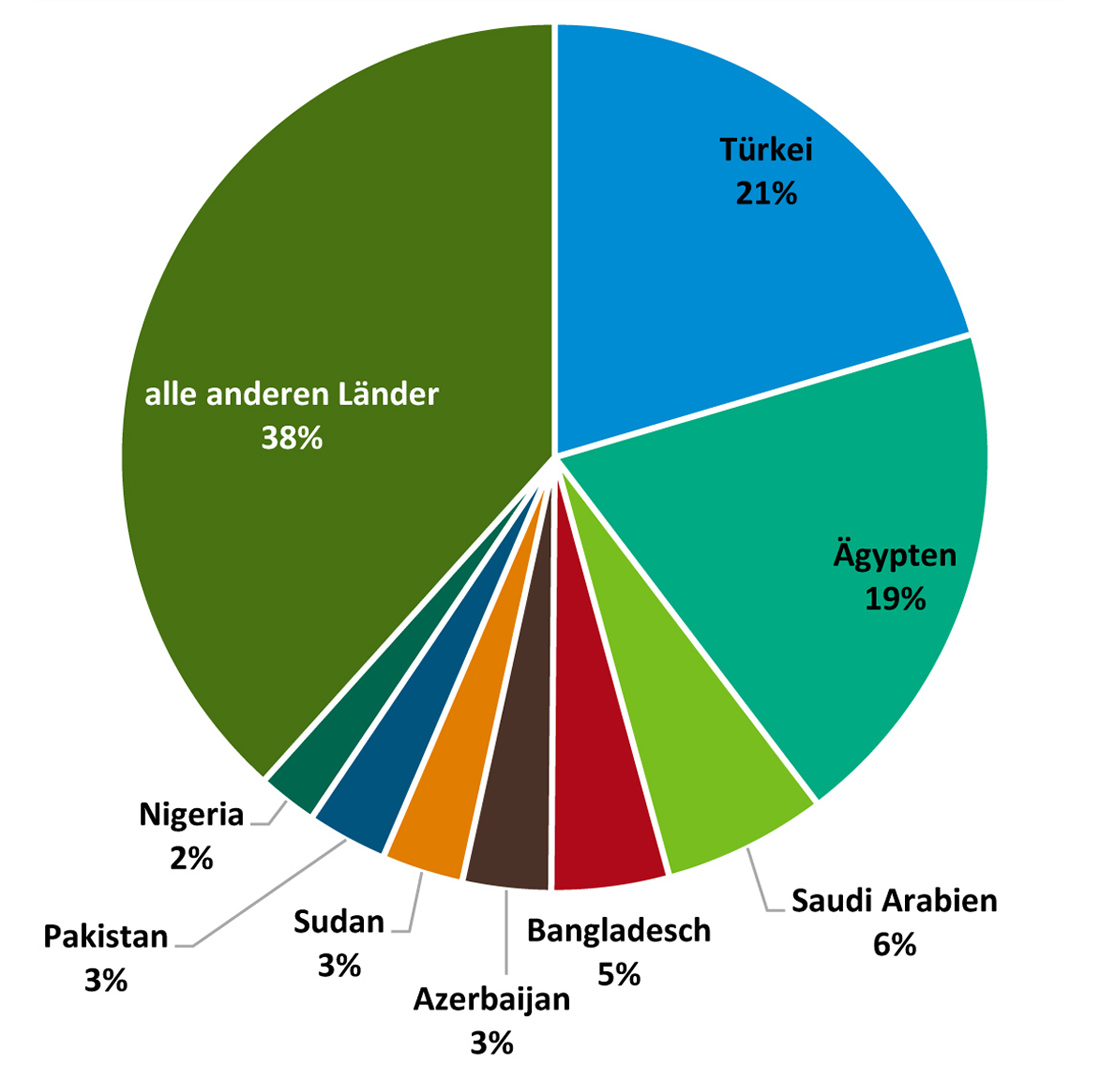

Further, it should be noted that more than 80% of Russian grain exports in 2020 were wheat, an important staple food in many countries. Here, the main importing countries are Turkey and Egypt. Ukraine's grain exports consist mostly of maize (55% share in 2020), which is used as animal feed, and wheat (35% share in 2020). The main importing countries for maize from Ukraine in 2020 were China and the EU, and for wheat Egypt and Indonesia.

The following graphs (Figs. 2 and 3) show the value-based proportional exports of grain from Ukraine and Russia to the main countries.

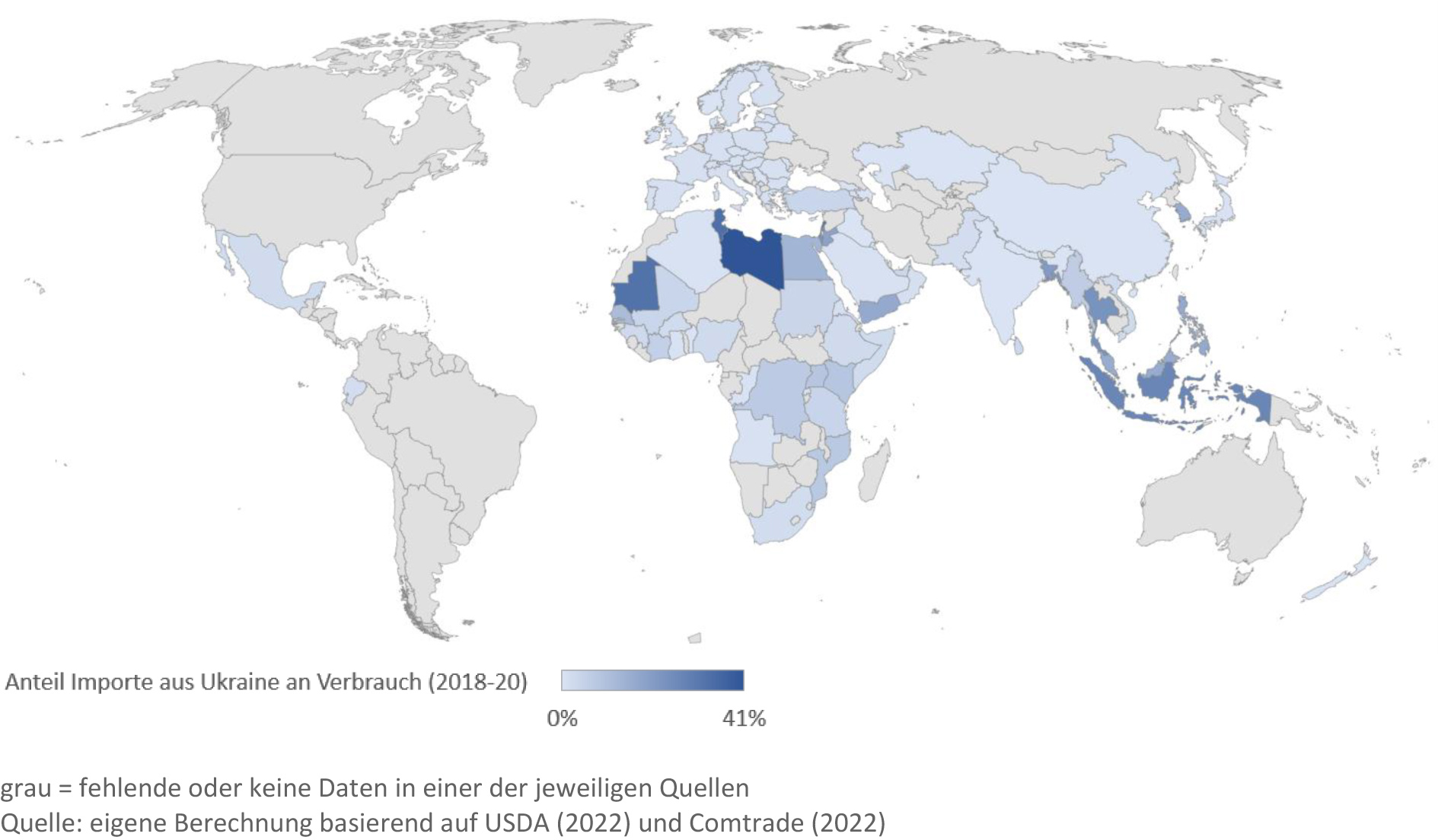

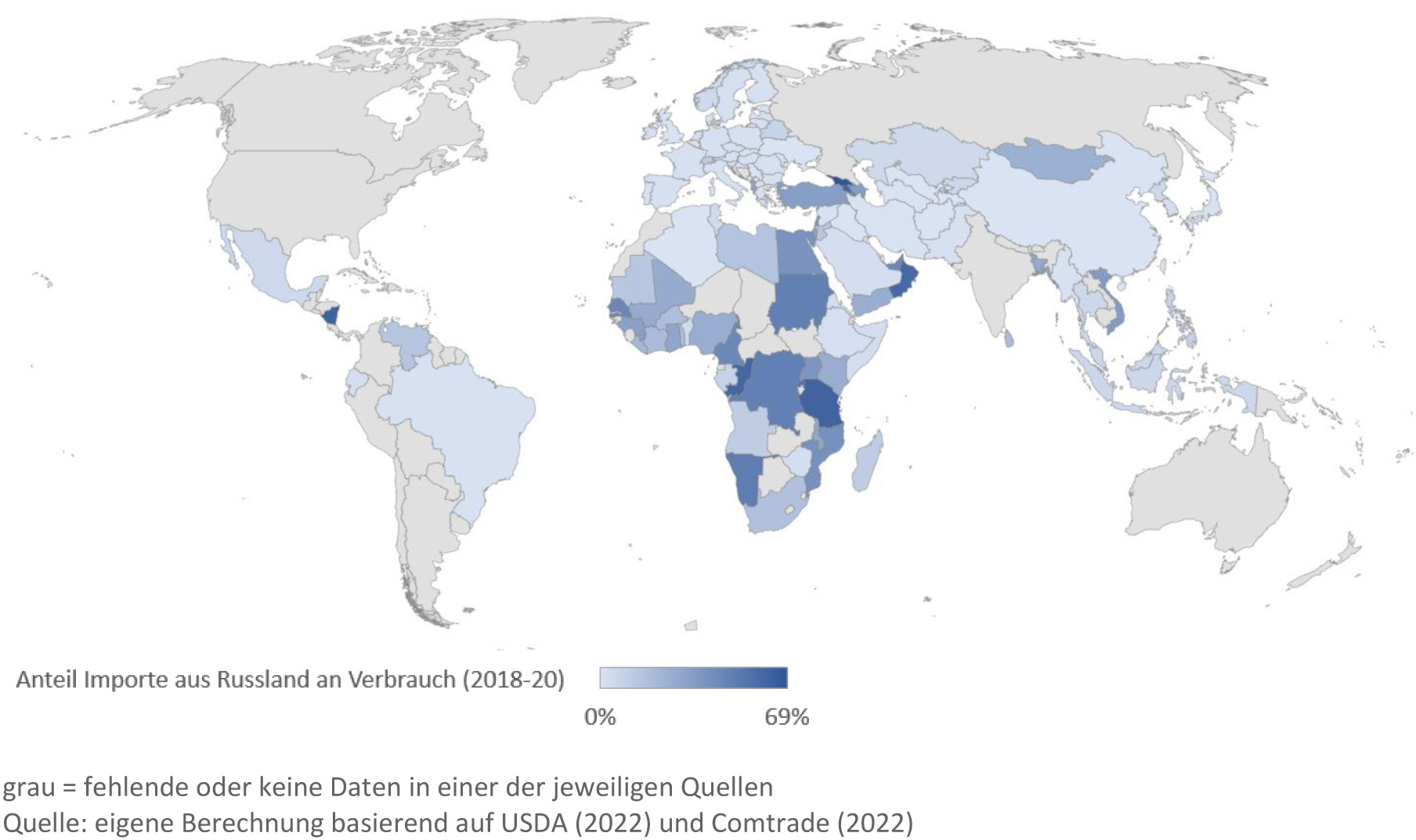

In many countries, Ukraine and Russia provide an important share of grain imports. Here, an export freeze would lead to significant supply shortages. Figures 4 and 5 show the share of Ukraine and Russia in all grain imports of these countries (based on value-based export figures). The higher the share, the more dependent these countries are on exports from Russia or Ukraine.

Dependence on Russian or Ukrainian grain and oilseed supplies particularly affects countries from the global South, countries with low per capita incomes, where food makes up a much larger share of private consumption expenditure. These low-income countries are particularly hard hit by the current price surge and an all-time high in the FAO Food Price Index (Fig. 6). Social tensions or even civil unrest could exacerbate the already precarious situation of these countries.

The situation is particularly problematic in crisis regions where a large proportion of the population is dependent on food aid, due to drought, civil war or mismanagement. Key examples are Somalia, Yemen and Afghanistan. A naive assessment of the situation: If the price of wheat doubles on the world market, international aid organizations can only buy half as much wheat for the same budget. And whether their budget for these countries really remains the same is questionable - at least in the case of organizations financed by donations - because Ukraine has opened up a new field for donations to flow into.

Not only plant-based foods are affected

Although the focus of the agricultural products currently under consideration is on cereals (here especially wheat and maize) and on oilseeds (sunflower seed, soybean), these products nevertheless have an 'anchor function' on the international agricultural markets. These products serve not only as the basis for food products such as bread and vegetable oils, but also as animal feed. Significantly rising prices for cereals and oilseeds thus also drive up the costs of animal production.

Also important at this point is the price increase for energy, which is causing production costs in agriculture, e.g. for diesel and fertilizers, to rise sharply. As a result, prices for all food products can be expected to jump.

There is no clear answer at present to how much food prices will rise. The important question here is not so much the level, but quite significantly the duration of the high-price phase. Looking back at the "food price crisis" of 2007/08, it is clear that prices also returned to a significantly lower level in subsequent years.

In the EU, food price increases caused by higher commodity prices can be classified as minor. This is because commodity costs account for only a small proportion of total production costs. Price increases in other areas, such as energy, can have a greater impact here. It should also be noted that households in the EU spend only a comparatively small proportion of their disposable money on food, in contrast to poorer countries which are dependent on food imports.

Options for market stabilization

In order to mitigate the foreseeable consequences of the current crisis, especially in the countries of the global South, concerted global action is needed. This should avoid unilateral, "selfish" policy measures such as export bans. These measures only exacerbate the current volatility in international markets and contribute to exporting hunger to the poorest of the poor. High-income countries should take steps to mitigate food price inflation with social policy instruments. Announcements of grain export bans, such as those by Hungary and Argentina, are examples of how such measures have exacerbated rather than reduced the crisis.

Especially in the wealthy industrialized nations such as Germany, a change in consumer behavior with less meat consumption and less food waste can help stabilize the markets.

Intensive and sustainable production – not a contradiction

Intensive agricultural production does not contradict sustainable production. In every production type, there are conflicting goals between economic, ecological and social aspects of sustainability. The goal should be to choose production types that have both high yields and low negative consequences for the environment and the climate.

It should be noted that currently global fertilizer prices are at very high levels. Fertilizers must therefore be used particularly efficiently. This would reduce the possible negative consequences of more intensive production for climate and biodiversity.

Internationally coordinated efforts must be strengthened to lower the barriers to sustainable intensification of domestic food production in countries that are particularly dependent on food imports. This applies in particular to access to land, yield-increasing inputs and education.