Expertise

Is a fish finger crisis looming?

Christopher Zimmermann | 08.04.2022

Russia is the fourth largest producer of marine fish in the world. The significance of Russian marine fish imports for Germany is highlighted here.

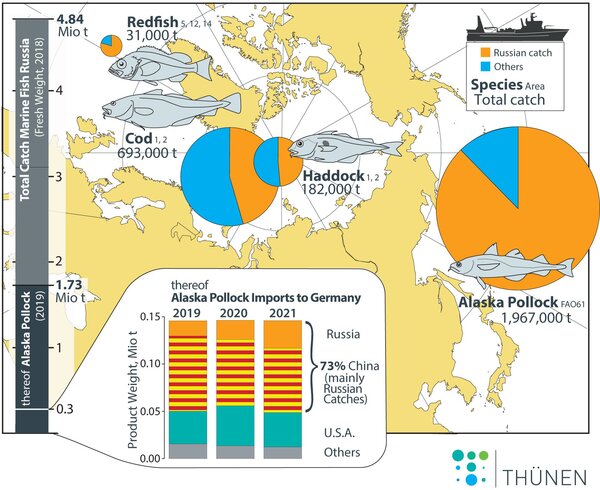

Russia is the fourth largest producer of marine fish in the world. According to the Food and Agriculture Organization (FAO), landings of Russian fishing vessels amounted to 4.84 million tons of marine fishery products in 2018. Russia is also of outstanding importance for imports to the EU and Germany, especially for one of the most popular marine fish on German plates, Alaska pollock, which is found in most fish fingers.

Between 2019 and 2021, direct Russian imports of Alaska pollock fillets to Germany increased from 16,100 to 29,000 tons. The value of Alaskan pollack imports from Russia in 2021 was 87.3 million euros. With the total volume of imports of this fish species remaining roughly constant at 146,000 tons, the Russian share has thus increased from 12 to 22% within three years.

Imports of Alaska pollock fillets from China declined from 79,700 to 68,100 tons. However, this product is only first processed in China and also originates predominantly from Russian fisheries in the Western Pacific (FAO Area 61). There, Russian fleets take more than 88% of the total catch of this species. Overall, therefore, around 73% of the Alaska pollock processed in Germany is currently likely to come from Russian sources (see figure).

As the figure shows, Russian fisheries have a pivotal influence on stocks in other areas as well, especially in the Northeast Arctic (Barents Sea). There, Russia's share of cod catches is 45% (313,000 tons) and for haddock 49% (89,000 tons in 2020). In the area between East Greenland and Newfoundland, Russia's share of redfish catches is about 80% (24,700 tons in 2018).

Germany is the main producer of fish fingers and various types of so called "Schlemmerfilets", made from the white and boneless meat of the Alaska pollack. The largest fish finger factories in the world are located in Germany, and a considerable part of the production is exported to other European countries.

Alaska pollock is a scarce commodity on the world market, although it is the white fish species with the highest yield in the world. Besides Russia, only U.S. fisheries produce comparable quantities. However, these are sold by long-term supply contracts and cannot substitute for a shortfall in Russian supplies. In addition, quotas of Alaska pollock from the western Bering Sea and the Gulf of Alaska (FAO67) have been reduced by almost 20% for 2022 in order to ensure continued sustainable utilisation.

Substitute wanted

The Russian Alaska Pollack fisheries are MSC certified, as are the American ones. However, it is expected that this sustainability certificate will be suspended for most Russian fisheries within a year because annual audits can no longer be carried out under the current conditions. This will become a problem for retailers who only want to sell MSC-certified goods. The import ban on Russian seafood announced by EU Commission President Ursula von der Leyen on April 5, 2022, on the other hand - contrary to agency reports - does not initially include fish fillets, but mainly crabs and caviar.

Therefore, the impact of the sanctions against Russia on the production of fish fingers and similar products will be minor – but that could change quickly. The industry is therefore considering compensating for the potential shortfall with other types of fish. In the past, pangasius, a freshwater fish produced in aquaculture, was used for this purpose.

A complete compensation will not be possible in the short term. An import ban or even a drastic increase in import tariffs on Russian fish, as has been implemented in the UK, would therefore have a significant impact on the supply and prices of the products as well as on jobs in the German fish processing industry.

Fish from Russian sources no longer purchased by the EU would likely be taken up easily in other regions of the world, such as Asia, albeit - due to the then missing MSC label - at a price discount.

Russia has also announced plans to unilaterally increase quotas for the Alaska pollock fishery in the western Bering Sea, which would then have a significant impact on the sustainable exploitation of this stock. In the short term, therefore, Russia could attempt to compensate for the loss of revenue due to the elimination of the western market by increasing catches.

Other effects of the war on the German fishing industry

As in most other sectors of the economy, the sharp rise in the price of fuel in particular is causing major problems for fisheries. This is particularly true for energy-intensive fisheries, i.e. bottom trawl fisheries, e.g. for flatfish or North Sea shrimp. As a result, many smaller businesses have ceased operations, at least temporarily. The German Federal government's relief program, which is intended to make energy cheaper primarily through tax cuts, is not effective because fuel for fishing is tax-exempt anyway. However, the EU has now launched an aid program that provides subsidies for fishing companies that have fallen into economic difficulties as a result of the war.

For the supply of the German market, own production by coastal fisheries does not play such an important role that restrictions in food security are expected. However, Russia's suspension from the International Council for the Exploration of the Sea (ICES) and from many intergovernmental regional fisheries management organisations will make sustainable management of shared resources very challenging in the near future.