Expertise

Replace imports with domestic soybean cultivation and loosen crop rotations?

Jannik Dresemann, Thomas de Witte, Yelto Zimmer (agri benchmark) | 12.05.2023

The large import volumes of soy are viewed critically for various reasons. In Germany, soy cultivation has risen sharply in recent years, but is still at a fairly modest level. Current obstacles and perspectives are described below.

German soybean imports mainly come from Brazil. There is much talk in public about replacing these imports because - so the hope - this can slow down the deforestation of the rainforest.

While global soybean cultivation is often criticized due to the use of genetic engineering and glyphosate, the cultivation of GMO-free soybeans in Germany could help solve challenges in arable farming. The background is that farmers are desperately looking for profitable leaf crops to make their crop rotations more diverse. This would mitigate the risk of herbicide resistance and reduce the use of mineral nitrogen. Therefore, the Thünen Institute has investigated the cultivation prospects of soybeans in Germany with partners from the agri benchmark network.

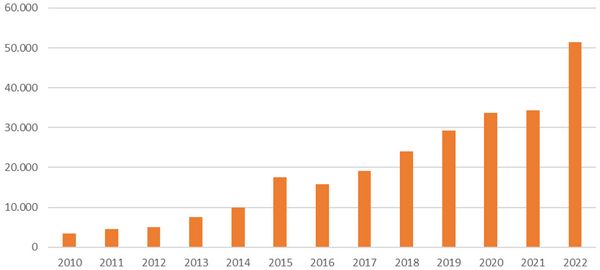

Soybean cultivation was at a very low starting level with 3,500 ha in 2010. Since then, the cultivated areas have grown rapidly and reached 51,500 ha in 2022, corresponding to an annual growth rate of about 22%.

Based on expert interviews and economic figures, the following picture emerges for the on-farm competitiveness of the soybean: Especially in the center of Germany and in the south, soybeans are often at the economic threshold. In Bavaria, exemplary calculations show that soybeans delivered similar gross margins of around 700 €/ha on average from 2019 to 2021 as rapeseed or wheat. The gap to maize was only 100 €/ha. However, during this period, premiums of around 145 €/ha were still paid here, which were initially left out of this calculation. Further north, however, competitiveness is not yet given. Thus, the gross margin disadvantage compared to rapeseed or wheat in the considered regions of North Rhine-Westphalia for the same period is still 200 €/ha; only in comparison to rye soybeans perform slightly better.

It is noteworthy that the extraordinarily high fertilizer and agricultural prices in 2022 did not improve the on-farm competitiveness of soybeans. Instead, example calculations for the regions presented above show that the gross margins for soybeans were roughly 500 €/ha lower than those of rapeseed, wheat or maize. Part of this development is because soybeans coped worse with the drought of 2022 than other crops and thus yield effects influenced the result. The main driver, however, is the fact that revenues for established crops have increased significantly more than for soybeans due to the higher yield level.

Obstacles in cultivation

The fact that not more farmers are growing soybeans is also due to a lack of experience and technology as well as difficult marketing. Since the regionally produced quantities are often small, their collection and transport are more expensive than for established crops. Furthermore, there are hardly any decentralized processing capacities available, so that the soybeans often have to be transported over long distances to the so far only mill in Straubing (Bavaria). This leads to high transport costs and thus to low farm gate prices.

Another economic obstacle to increased cultivation of soybeans in Germany is the German plant variety protection law. Unlike cereals, it prohibits the replanting of soybeans. As a result, seed costs in Germany are about 170 €/ha higher than in our European neighbours. And internally in Germany, seed costs for established crops such as wheat or rapeseed are over 200 €/ha lower than for soybeans.

Due to the strong domestic demand for GMO-free soybean meal, soybean prices in Germany are relatively high compared to other European countries. While they are about 10 % lower than rapeseed prices in Hungary, for example, German farmers receive 10 % higher prices for soy than for rapeseed.

The complete report on the cultivation perspectives of soybeans in Germany is published as Thünen Report 169.

![[Translate to English:] Logo des Bundesministerium für Ernährung und Landwirtschaft](/media/allgemein/logos/BMEL_Logo.svg)